Top 10 Insurance Trends to Watch in 2024

Technology is still catching up in all areas of life as it evolves to provide more accessible solutions; this also applies to insurance companies.

These insurance companies or companies are constantly evolving while coming up with new ideas and creativity to enrich your life. So, let's highlight the hottest insurance trends right now.

What are the top ten most essential insurance trends in 2024?

Technology has taken the world by storm. At the same time, insurance trends are also a sign of progress and revolution. Here are the top ten insurance trends to watch in 2024.

1. Improve attitude

Did you know that many well-known insurance companies have experienced significant layoffs?

But that happened a few years ago. According to a report from the Center for Insurtech, these companies have begun recruiting more talent globally. Therefore, most layoffs in 2024 are unlikely.

Based on this survey, the following key facts and figures were identified for 2024:

● 50% of insurance companies or companies want to hire more staff to meet the growing demands of their current business; a recent labour market study found this.

● 56% of life and health insurance companies want to welcome new members.

● 10% of insurance companies said they may allow some employees to be laid off.

● 27% of insurance companies continued doing business with their existing teams.

● Some statistics also show that 63% of insurance companies want to increase hiring.

● 65% of property and casualty insurance companies also consider expanding their teams.

2. Rapid digital transformation

Traditional insurance methods will no longer exist. The reason lies in the rapid development of Internet technology and its integration into all areas of life. In 2024, you can analyze the digital age's positive impact on the current insurance era.

Recently, the insurance industry has been seen integrating massive amounts of data and technology in the following ways:

● Integration of artificial intelligence.

● Use natural language processing (NLP).

● The emergence of the technological Internet.

● Blockchain technology is wildly popular in the insurance industry.

The insurance industry is undergoing a digital transformation, primarily as it grapples with climate change. It provides practical risk management tools and techniques to cope better with adverse weather.

3. Change the business model

Insurance business models are no longer talked about because they are growing massively. Their main growth area is embedded insurance. The industry has taken the market by storm and is rapidly changing how traditional insurance strategies are considered.

Today, traditional insurance companies are extending a hand of friendship to their non-insurance partners. They do this to integrate the sale of the insurance into the initial transaction process, thereby reducing the dreaded impairment risk.

Global embedded property and casualty sales are expected to exceed $700 billion. At the same time, U.S. sales are expected to grow by about $70 billion in 2030. However, these statistics may change from time to time.

Tesla, Root Insurance and Ford are known for their embedded insurance. They were pioneers in providing vehicle insurance.

4. Cybersecurity insurance trends

As you know, machine learning, artificial intelligence, and cybersecurity threats are increasing daily. Therefore, there is a great need to protect companies and individuals from malicious attacks.

Evidence shows cybersecurity insurance is one of the areas with the most significant growth globally. However, there will be a substantial increase of about $23 billion in 2025 and about $315 billion in 2028. It may give the industry a reputation in the market.

5. Risks of climate change

You'll quickly see the profound relationship between insurance and consumers and beyond. Insurance companies have begun to realize their essential role in climate change.

That's why they're trying to help more communities and reduce negative climate change in 2024. Your attention turns to positivity and reducing environmental risks caused by unforeseen disasters.

6. Improve customer service

According to Deloitte (a world-renowned multinational company), insurance companies will improve customer service in 2024. They are more willing to work together and keep their customers happy.

Furthermore, their main goal is to prevent problems rather than solve them. Insurance companies will try to meet customers' needs by inventing special tools.

7. Latest health plans

Insurers are changing the way they think about work, and fast. From 2024, airlines will do their best to protect people's health and well-being.

These are what everyone pays the most attention to. As a result, companies are striving to do more good in the world than before.

8. Automating insurance through artificial intelligence

Technology is relentlessly changing the way insurance companies handle claims. For example:

● Blockchain and AI strategies can help protect your data and speed up processes.

● Robotic automation makes claims processing more accessible, more efficient, and faster.

● IoT enables insurance companies to provide reliable policies and decisions and easily detect fraud.

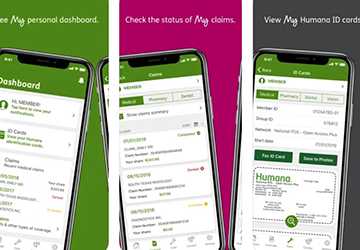

9. Increase application production

There has been a massive increase in mobile insurance apps in recent years. According to Allied Market Research, insurance app development spending was approximately $7 billion in 2020-2021.

However, the same report states that brokerage apps have grown by more than 460% since last year. But it will continue to grow, albeit with some deviations from expectations.

10. Advanced insurance technology

One of the latest technologies is augmented reality. It means connecting the worlds of fantasy and reality, which overlap, and users think it's an applicable word.

AR technology is expected to help insurance companies improve their business.

last words

Insurance companies have evolved overnight due to the latest technological innovations. So, look at the top 10 insurance trends to watch out for in 2024. Instead, stay tuned for other current innovations; this means both insurers and customers receive a balanced service.