Top 10 Insurance Myths Busted

There are some common myths and misconceptions surrounding insurance. Some people think it's costly; others don't take it seriously when young. All of this happens because of the wrong concept of insurance in our minds.

That's why today we're writing an article about the top 10 insurance myths that have been debunked. This way, you can avoid unnecessary situations and make an informed decision.

Myth 1: I don't need renters insurance because I don't own enough

Many of you think there is no need to buy renters insurance because you need more possessions. But that shouldn't be the case. Otherwise, you may fall into the trap of significant losses.

If you follow these tips, you'll understand the importance of renters insurance:

● Walk through your home thoroughly and analyze each item individually.

● List the cost of every item in your home, even if it's not particularly expensive.

● Now, calculate the total cost of all these things being damaged by a disaster. If you knew this number, you would be surprised.

● Your landlord may even require you to purchase renters insurance.

Myth 2: I don't need health insurance when I'm young

Your health status has nothing to do with your age. Today, teenagers are suffering from severe illnesses due to unhealthy environments and other conditions. So why do you think you don't need health insurance when you're young?

It would be helpful if you had it to cover your medical bills. Even if you are young, you can buy it cheaper than when you are older. Insurance companies provide reasonable premiums from a young age because health risks are lower in this age group.

But as you age, so do your age and health risks. Therefore, insurance companies will pay high premiums based on your health risks.

Myth Three: Only the Rich Need Umbrella Insurance

Umbrella insurance is extra coverage that protects you better than a home, car, or policy. With this policy, you can get the protection you need:

● Prevent injuries.

● Handle certain litigation.

● Personal liability settlement.

So it's not just the wealthy who need umbrella insurance. You are equally susceptible to this situation if you need a lawsuit and your home has a swimming pool, trampoline, etc. In this case, it would be wiser to purchase umbrella insurance to avoid spending extra money if you accidentally slip or get injured.

Myth #4: Getting help from an independent insurance agent is expensive

You may think working or hiring an independent insurance broker is costly. You don't need to pay any extra for their professional help. Instead, the insurance company is responsible for settlement.

However, even if you are a beginner, these professionals can make learning about insurance easy. So don't avoid buying life, lease, auto or insurance because of the myth that independent agents are expensive. You might be surprised that they don't charge you directly for their expertise.

Myth #5: I don't want to buy life insurance because I'm single

No, you need life insurance even if you are single and have no dependents. Life insurance can help you protect your debts and other expenses; your loved ones don't have to worry if your debt goes unpaid. Your insurance company handles this.

Additionally, it pays to buy life insurance when you're young because it is cheap. Therefore, if you plan to expand your family, you should purchase life insurance at a young age because it will cost more if you buy it after marriage.

Myth #6: Life insurance is too confusing

Buying and purchasing life insurance is relatively easy. If you do not want to hire a professional insurance broker to help you, you must follow these steps:

● Find a reliable insurance broker.

● Start your insurance application.

● View and compare different insurance options.

● Choose the one that suits your needs.

● Pay the monthly premium first.

● Unfortunately, if you leave this world during this process, your family may seek compensation.

Myth #7: My small business doesn't need insurance

Most small businesses, if not all, require minor injury or property damage coverage. So stay away from insurance and think you own a small business. Your business may need insurance if:

● Your business is vulnerable to lawsuits.

● Equipment is expensive.

● Environmental hazard.

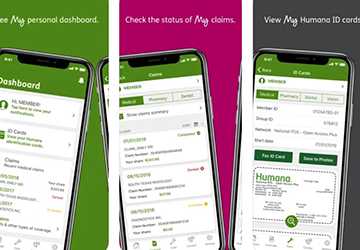

Myth #8: Online life insurance is fake

If you follow trustworthy apps or websites, you should know that online insurance is not a scam. Instead, most insurance companies have digitized their systems to streamline processes.

You can search for different plans online and choose one from the comfort of your home. So when you're short on time, the process is easy and safe.

Myth #9: My employer offers enough term life insurance

It is enough if your employer provides you with life insurance. But remember: If you leave your job or the company closes, you no longer have coverage. However, achieving this through Group Policy requires more. There needs to be more.

Myth #10: I should invest the difference and always buy the duration

You should always buy term life insurance and invest your savings; sometimes, it's right. It's all about disciplined investing.

But again, this is not guaranteed, and term life insurance may expire before you need it.

Conclusion

Purchasing insurance as early as possible is an intelligent decision, whether life, health, car or property insurance. Once you see the benefits, you can guarantee the results yourself.

However, we recommend you seek professional help, especially if you are a beginner; this will save you a lot of unexpected costs.