How to Compare Insurance Quotes Online?

Searching for reliable insurance can feel overwhelming. With all these companies and quotes, where to begin?

Fortunately, the Internet has made it possible by allowing you to compare quotes online and then choose one according to your needs. Here, we have compiled seven easy steps to help you understand how to compare insurance quotes online without hassle.

7 Steps to Compare Insurance Quotes Online

These seven easy steps can clear your confusion about comparing insurance quotes online. It would help if you had a little research work to get outstanding coverage at your desired price. So let us see how these comparison steps can help you find a perfect fit:

Step 1: Gather Your Information

The first step in comparing your insurance quotes online is to gather your information. It means you have to collect your given basic information before jumping online to start the research process:

● Please provide all essential information, such as your name, address, contact number, etc. In some cases, you may also need confirmation of your date of birth.

● What type of insurance do you want? Do you need life insurance, auto insurance, health insurance, or any other kind? Choose and confirm any of them according to your current needs.

● You should have all the details of the thing you want to insure. For instance, if you're going to get car insurance, you should know its make and model and every aspect in detail. Similarly, obtain necessary and detailed information about your home or anything else you want to insure.

● You must have a good driving record. A clean driving license can award you significant discounts on insurance.

● Lastly, if you are switching insurers, check your current insurance policy. You must make sure of all the coverages, limits, and deductibles. It would help if you had a clear idea of what you already have in place before continuing with new insurance.

Step 2: Check Your Coverage Limits

Coverage limits or sum insured means the maximum amount your insurer can pay when you claim a payout. The next important step is to confirm when you want to compare the insurance quotes online. To carefully complete this step, you should follow the given tips:

● Firstly, review your current insurance policy if you have any. Determine the limits your current insurer has set for the coverages. These can vary from home and auto to health and life.

● Analyze your coverage limits. Consider your current life situation and financial situation. Then, decide whether the targeted insurer's coverage limit will be enough to meet your needs. For instance, will your coverage limit be enough if you ever need help against unexpected events?

● Auto and homeowners insurance requires a liability limit more than other insurance because it protects your assets in case you ever have to face lawsuits due to harming others or their homes. Your liability coverage should be enough to cover your damaged belongings.

● Determine if the deductibles align with your pocket needs or not. It is the amount you have to pay before your insurance starts. You should confirm it for each coverage before making a decision.

Step 3: Choose Your Insurance Comparison Source

Next, you must choose a tool to compare your insurance quotes online. Initially, there are two ways of comparing your online quotes:

1. Online Companies Websites

Some insurance companies offer websites to get a quote online; this can be a good option if you have selected some good companies already.

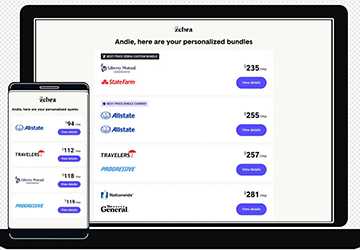

2. Online Comparison Websites

There are also online insurance comparison websites. These sites gather quotes from various companies and let you choose the best one. They can be another good option to analyze multiple quotes simultaneously.

Step 4: Start Comparing

Once you have selected your comparison tool, it is time to compare.

You have to compare the quotes of every company at the same level of coverage. Doing this will ensure you decide the correct path to your actual cost.

Step 5: Analyze the Afterwards Perks

Sometimes, your insurer may be working and serving you nicely due to their sales concern. Unfortunately, however, they changed entirely after their successful sale.

So, ensure that this is not the case with your insurer. Otherwise, you may be disappointed.

An excellent way to check their positive customer experience is through online reviews. Please look deeply at how they have served their previous customers and whether they are happy with their services. Don't select their services if they need more good reviews and recommendations.

Step 6: Don’t Just Look at the Price

Price matters for sure in insurance. However, it should only be one aspect of deciding on a suitable insurer. Instead, you should also follow the given tips:

● Ensure your targeted insurance company is providing the type of coverage you need.

● Read online reviews of previous customers about your targeted company or comparison website.

● Confirm if the given company or insurer is providing you with some discounts. For instance, some may award you with good discounts in case of a good driving record or bundling multiple.

Step 7: Make Your Choice

Compare all the quotes; these. These should be from various companies, not a single one. Then, carefully follow the above and some other vital factors in your policy.

Accordingly, choose an insurance company that fits your needs. You can even clarify your queries (if any) by contacting these companies.

Conclusion

Consequently, how to compare insurance quotes online should not be a matter of consideration when you have followed the above seven steps carefully. You should choose a company or quote you can afford without affecting your pocket.

All this is relatively easy with the help of online insurance services. You don't have to step out of your home. Just do a little deep research, and you will be all done saving your belongings in case of an emergency.