How to Choose the Right Life Insurance Coverage

Indicating the correct lifetime indemnity plan is a crucial decision with persistent consequences for you and your precious ones. In this guide, we'll walk through essential tips conversationally and straightforwardly to help you navigate the complexities of life insurance. From assessing your needs to understanding policy types and considering your health, each step is designed to empower you in making a well-informed choice.

Key Considerations When Choosing Life Insurance

Now, let us dig into the vital considerations that will channel you into picking the most appropriate lifetime indemnity plan for all your requirements and conditions.

Assess Your Needs

One size does not fit all when it comes to lifetime indemnification. To determine the right coverage, start by evaluating your current financial situation. Take stock of your income, debts, and day-to-day expenses. This information will give you a baseline for how much coverage you need.

Consider what would happen if you could not provide financial support. Would your loved ones be able to cover outstanding debts like mortgages or loans? Would they have enough to maintain their current lifestyle? Assessing these needs helps you arrive at a ballpark figure for the coverage amount.

Look beyond immediate needs, too. If you have children, think about their education expenses. If you have specific financial goals, such as leaving an inheritance, factor those into your calculations. By taking a comprehensive approach, you ensure that the life insurance policy you choose aligns with your unique circumstances.

Understand the Different Types of Coverage

Life insurance isn't a one-dimensional product. It manifests in different forms, and grasping these choices is essential for making a well-informed decision.

Term Lifetime Indemnity: This category covers a limited tenure, like ten, twenty, or thirty years. A bereavement profit is reimbursed if you die during the tenure. It's a straightforward and affordable option, especially for those with temporary needs.

Everlasting Lifetime Indemnity: This kind offers plans for your complete lifespan. It provides a money value module that extends over time, delivering a savings element. Various modifications include complete lifetime, universal lifetime, and inconsistent lifetime indemnity. While these policies can be more expensive, they offer lifelong protection and potential cash value growth.

Understanding the nuances of these options can help you choose the type of coverage that best suits your goals and financial situation.

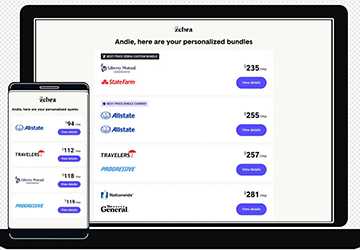

Shop Around and Compare Quotes

Refrain from settling for the first-lifetime indemnity quote you get. Prices can vary significantly between insurance companies, so shopping around is essential.

Consider More Than Just Price: While cost is a significant factor, it's not the only one. Watch into the fiscal strength and standing of the indemnity firm. A financially stable insurer will likely fulfil its obligations in the long run.

Evaluate Policy Features: Compare the features and benefits of different policies. Some policies may offer additional riders or perks that align with your needs. Ensure you're getting value beyond just the coverage amount.

Watch Out for Exclusions: Every policy has its terms and conditions. Pay heed to any refusals or restrictions that may be applicable. Realizing these aspects helps you attain an educated judgment and avoids revelations.

By shopping around and comparing quotes, you can secure a lifetime indemnity plan that suits your financial statement and offers the protection and characteristics you require for peace of mind.

Consider Your Health and Lifestyle

When requesting lifetime indemnity, your health and regime are crucial elements that indemnity firms consider. Your overall health, medical history, and lifestyle choices, such as smoking or regular exercise, can significantly impact the cost and availability of coverage.

Indemnity firms often require folks to undergo a health test to examine their health condition. It's essential to be transparent about any pre-existing health conditions during application. While people with good health wish to receive fewer rewards, those with specific health problems may face more significant costs or certain restrictions.

Understanding how your health and lifestyle influence your life insurance application allows you to anticipate potential challenges and choose a policy that aligns with your unique circumstances. By furnishing precise details and understanding how your health affects insurance premiums, you can make well-informed coverage choices that align with your requirements and financial means.

Review and Update Your Policy Regularly

Life is full of changes, and your financial needs may evolve. Occasionally, evaluating your lifetime indemnity plan is vital to ensure that it persists in converging your current obligations. Lifetime affairs such as weddings, the birth of your kid, or substantial occupation amendments can severely impact your monetary circumstances and, accordingly, your indemnity needs.

As you progress through life, paying down debts, accumulating savings, or reaching certain milestones, your need for life insurance may decrease. Conversely, if your family grows or you acquire more financial responsibilities, you may need to increase your coverage. Regularly reassessing your policy allows you to make necessary adjustments, ensuring that you maintain the right level of coverage without overpaying or being underinsured.

Be Mindful of Policy Exclusions and Limitations

Life insurance policies have specific terms and conditions, often exclusions and limitations. These are the situations or circumstances under which the insurance company may not pay the death benefit. Reading and understanding these details in your policy documents is crucial.

Standard exclusions might include death resulting from certain high-risk activities like extreme sports or hazardous occupations. Additionally, some policies may have a suicide clause, specifying that the death benefit won't be paid if the insured person takes their own life within a specific timeframe after the policy's inception.

Conclusion

In life insurance, informed decisions pave the way for financial security. You can confidently choose coverage aligned with your unique circumstances by assessing your needs, understanding policy intricacies, considering health factors, and staying mindful of exclusions.

Review your life insurance regularly and, if needed, seek professional guidance to ensure that it adapts to your evolving life. This guide aims to simplify the process, allowing you to embrace the future with the assurance that you've chosen the suitable lifetime indemnity scheme for yourself and your precious ones.